47+ how much does mortgage interest deduction save

Web With the interest on a mortgage being deductible when you itemize deductions it may surprise you how much you can save in taxes. Therefore if your taxable income is 50000 and you paid 5000 in mortgage interest your taxable income would be reduced to 45000.

2023 Tax Deduction Cheat Sheet And Loopholes

Web Most homeowners can deduct all of their mortgage interest.

. At the end of the year you deduct the interest from your taxable income reducing your overall tax burden. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Lets say you paid 10000 in mortgage interest and are.

Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. If you took out your home loan before. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. If youre single you should.

Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. Web Supposing that your top marginal tax rate is 32 percent the deduction will save you 5120 on your taxes 32 percent of 16000. Web In other words the Mortgage Interest Deduction would save this American 1163 per year in federal income tax.

Over the course of 30 years that annual number. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Homeowners who bought houses before. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. However higher limitations 1 million 500000 if married.

Use this calculator to determine your. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Web Tax deductions are not the same as credits. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to.

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Common Tax Deductions And Credits For Small Business

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Tax Deductible Mortgage Interest All You Need To Know Viisi Expats

2023 Tax Deduction Cheat Sheet And Loopholes

What Is Mortgage Interest Deduction Zillow

.jpg)

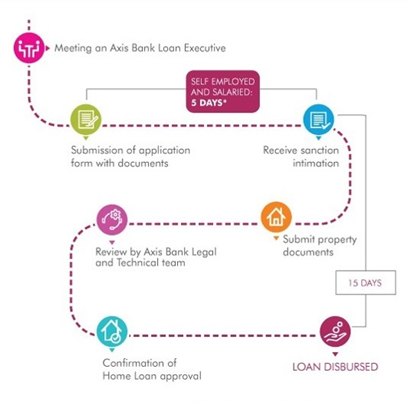

10 Tips To Get The Right Home Loan Offers Axis Bank

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

5 Parts Of Your Mortgage Payment Axis Bank

Home Loan Apply Housing Loan Online Rs 787 Lakh Emi Axis Bank

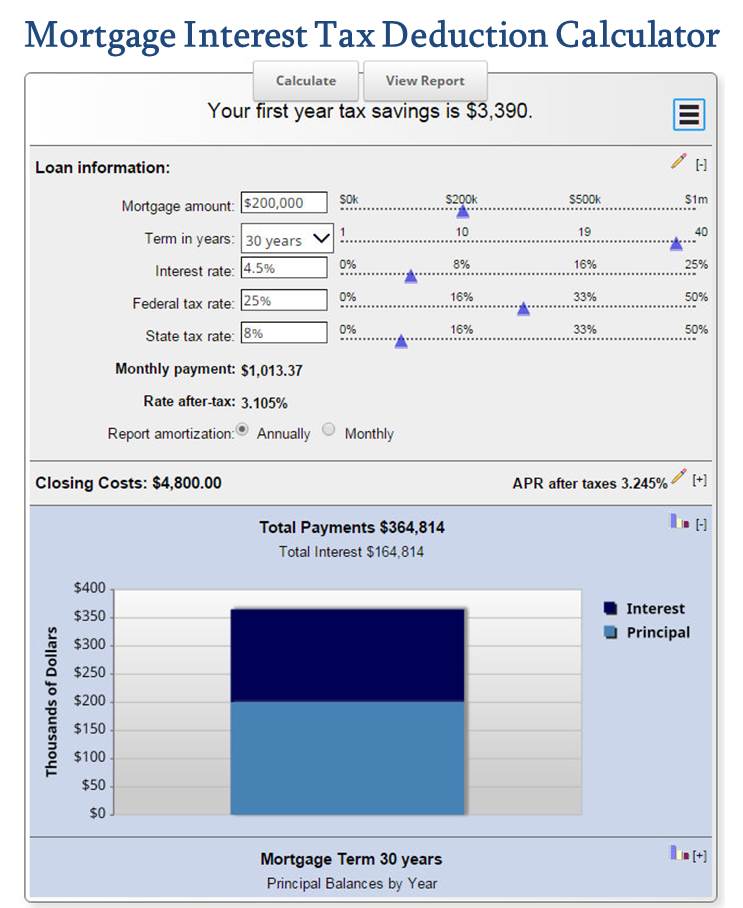

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Mortgage Tax Deduction Calculator Homesite Mortgage

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction How It Calculate Tax Savings

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos